IPO investment is a great chance for investors to be part of a company’s growth from very initial stages. Even though it looks very easy to invest in IPO but the matter of fact is, IPO investment requires proper research and analysis. This article highlights the important aspects of IPO investing and how can one participate effectively.

What is an IPO?

An IPO (Initial Public Offering) is launched when a private company decides to offer the shares of its company to the public for very first time thus becoming a public company. Capital raised through IPO is used for expansion, repayment of company debts and for funding of new projects. For Investors it is an opportunity to buy shares of the company before it is listed on stock exchanges for trading.

Why Do Companies Launch IPOs?

- Raising of Capital: Generally, companies prefer to introduce an IPO when they need additional capital for further company expansion. IPOs provide a great platform to raise large amounts of money.

- Public Listing: By making the company public, more and more investors can invest in the company and it strengthens company’s visibility and credibility.

- Exit for Existing Investors: Company also prefers to introduce IPO when the initial promoters as well as Venture capitalists wish to sell their stake in the company to the public.

- Liquidity: By making the company public, more and more investors will invest in the company, thus making it easier for shareholders to buy and sell shares anytime.

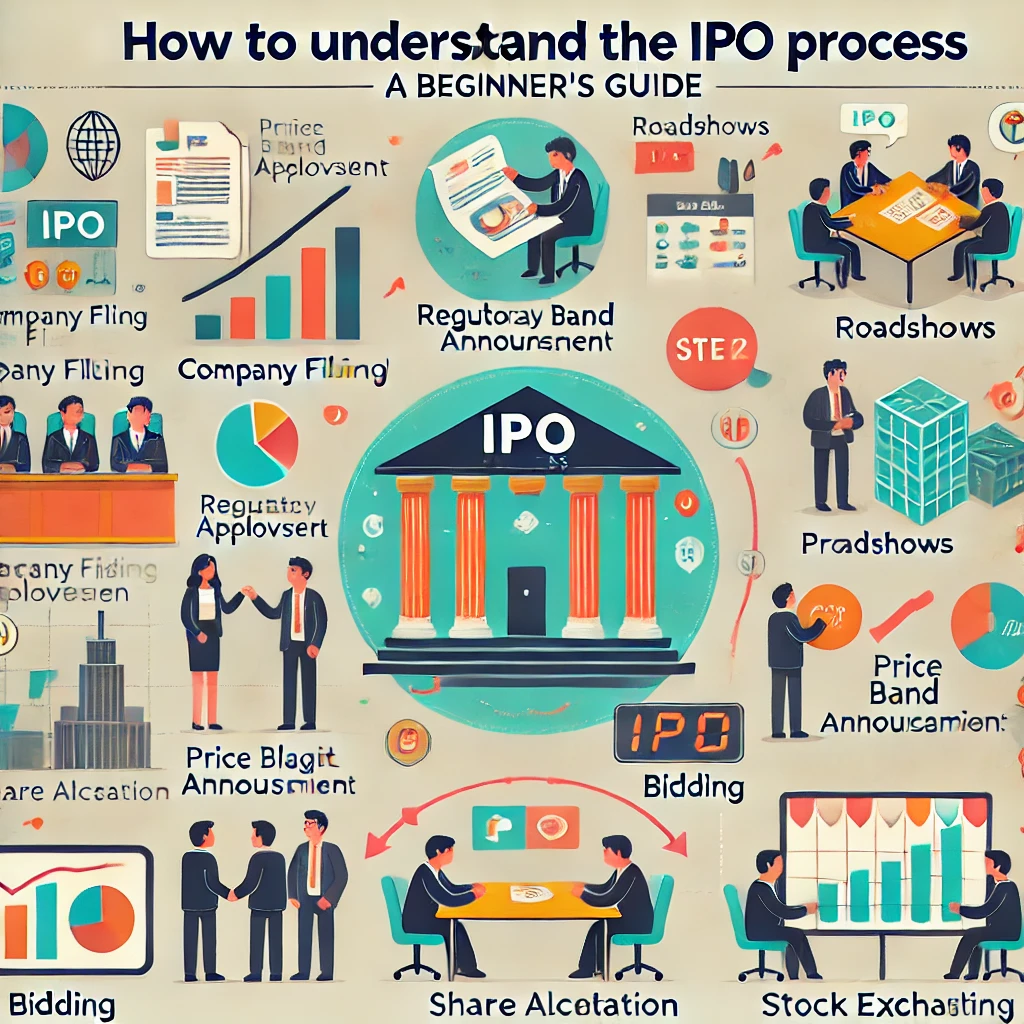

The IPO Process

Understanding the process for applying IPO can help in applying it more precisely:

- Decision to Go Public

The company decides to go to public for achieving specific goals and raising of additional funds. For this it appoints bankers and underwriters for guiding in this process.

- Filing of the Draft Red Herring Prospectus (DRHP)

The company submits DRHP to the SEBI (Securities and Exchange Board of India) for its approval. DRHP contains vital information about the company, its business planning, business models, financials, risks, and the sole reason for introducing IPO to the public.

- Regulatory Approval

SEBI goes through the DRHP to make sure it follows regulations. Once it is checked and approved, the company progresses ahead with the IPO.

- Roadshows and Marketing

The company will than starts its marketing to create awareness about the company and its future growth prospects to financial institutions as well as retail investors. During this marketing campaign company’s management explains regarding the business model as well as its financial performance and growth plans.

- Price Band Announcement

The company with the help of underwriters, decides the price bank and declare the same to public.

- Bidding Process

The IPO is than available for subscription at a pre-defined date which typically lasts for 3-4 days. Investors can place bids during this period within the price band.

- Retail Investors: Investors can apply for IPO through various platforms for ex broker or trading platforms.

- Institutional Investors: This includes big institutions like mutual funds, insurance companies, and other foreign institutional investors.

- Allocation of Shares

Once the subscription period is closed, the company allocates shares to the investors on pro rata basis.

- Listing on the Stock Exchange

Once the allotment is completed, the company lists on stock exchanges i.e. Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

Types of IPOs

- Fixed Price Issue

The company offers shares at a fixed price and it is made aware to the investors before submitting the application.

- Book Building Issue

In this method, the company declares a price range and the investors can bid for shares within this range. The final price is set as per the demand.

How to Apply for an IPO

We will provide you in detail regarding the steps for applying an IPO:

- Open a Demat Account

To Apply for an IPO one should have an active demat as well as trading account with any registered broker.

- Check IPO Details:

Check all the details of IPO thoroughly such as company’ details, financials, future goals, price bands and important dates.

- Place a Bid:

Once you have active trading account, just log in into your account and apply for the IPO under the “IPO” section. Enter the quantity and price within the prescribed range. - Blocking of Funds (ASBA)

The amount required for buying of IPO is blocked in your savings account and it is either debited if you get the allotment or released if you have not received allotment.

- Allotment and Listing

If the shares are allotted to you than the same will be reflecting in your demat account and if it is not allotted to you than the amount in your savings account will be refunded.

Risks Involved in IPO Investing

- Market Volatility: Many Investors tend to book profits as soon it is listed, thus creating lot of volatility in the share price movement.

- Overvaluation: There are many instances in the past wherein the IPO was overhyped as well as overpriced and the outcome of such IPOs is always loss of money.

- Company Performance: There is no guarantee of future performance and there are chances that company is not able to achieve the goal for which they had introduce IPO.

- Limited Information: Since there are no historical data available for the newly introduced company, invest in such companies becomes difficult from long term perspective.

Tips for IPO Investment

- Research Thoroughly: Read the offer document properly and understand the reason presented by company for bringing the IPO.

- Avoid Hype: Always stay away from the Company which is over Hyped in the public Domain. There is high probability that company may perform poorly on the listing day itself.

- Set Goals: Be very clear in your mind the reason for you investing in an IPO, whether it is just for the listing gains or for long term investment.

- Diversify: One should not Invest all the money in one Instrument; to get the maximum returns all times, it is important to diversify one’s investment portfolio.

Conclusion

IPO present a very good opportunity provided one has a fair idea about the company and its reason to introduce IPO. Always take help of professionals to get a fair bit an idea regarding the prospect of the IPO.

Investment in securities market comes with its own share of risk and opportunities. So trade wisely.