Credit card statements can seem intimidating at first glance, filled with jargon, numbers, and complex terms. However, understanding your statement is essential to managing your finances effectively, avoiding unnecessary fees, and maintaining a healthy credit score. In this guide, we’ll break down the key components of a credit card statement and provide tips on how to interpret it.

1. Why It’s Important to Read Your Credit Card Statement

Ignoring your credit card statement can lead to missed payments, accruing interest, or even fraud going unnoticed. Here’s why you should make it a habit to review your statement monthly:

- Track Your Spending: Understand where your money is going and identify unnecessary expenses.

- Avoid Errors and Fraud: Spot unauthorized transactions or billing errors promptly.

- Stay on Top of Payments: Ensure you’re paying at least the minimum due to avoid late fees and penalties.

- Improve Financial Planning: Use insights from your statement to create or adjust your budget.

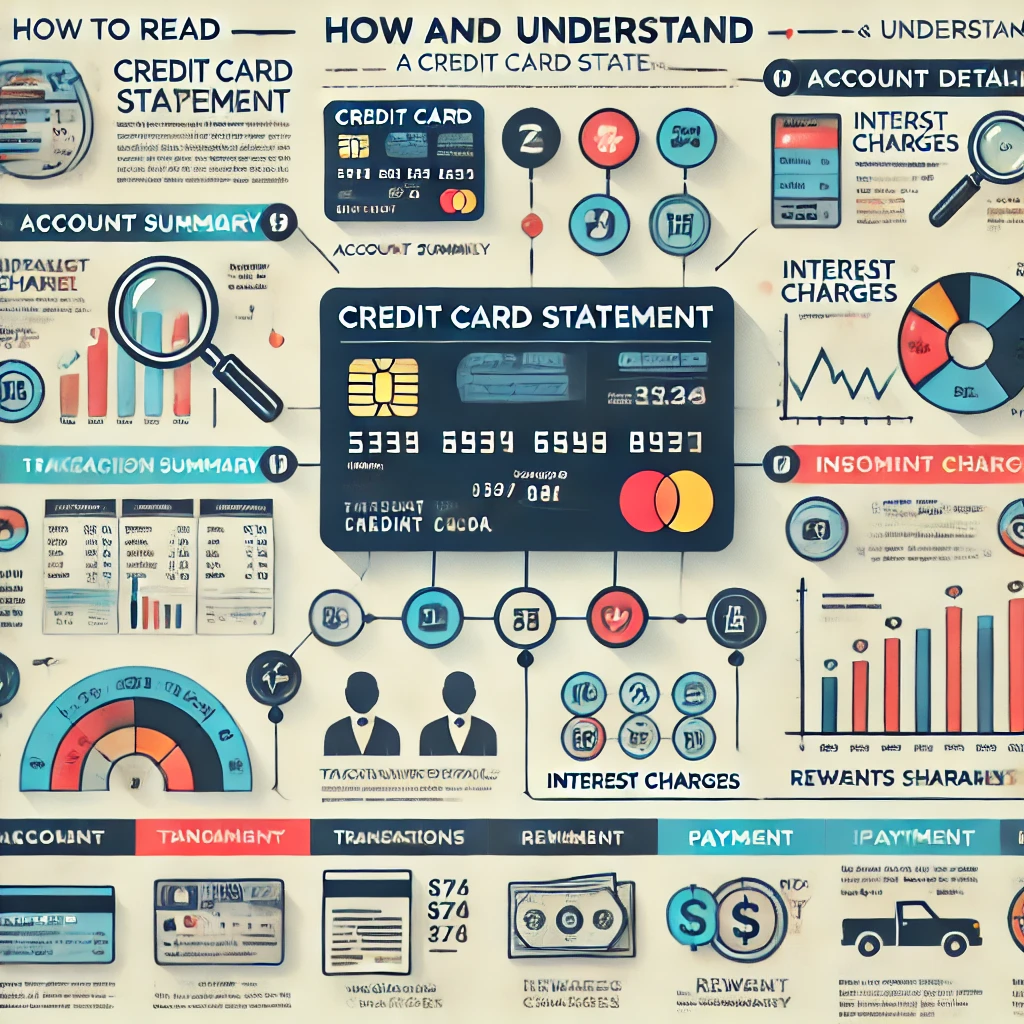

2. Key Sections of a Credit Card Statement

Every credit card statement typically contains the following sections:

a. Account Summary

This section provides an overview of your credit card activity for the billing cycle. It includes:

- Statement Period: The dates covering the transactions listed in the statement.

- Credit Limit: The maximum amount you’re allowed to borrow on the card.

- Available Credit: How much of your credit limit is still unused.

- Previous Balance: The balance carried over from the last billing cycle.

- Payments and Credits: Payments you made or refunds received during the statement period.

- New Charges: The total of all purchases, cash advances, and fees.

- Minimum Payment Due: The minimum amount you must pay by the due date to avoid penalties.

- Payment Due Date: The deadline for making your payment.

b. Transaction Details

This is a detailed list of every transaction made during the billing cycle, including:

- Date: The date when the transaction was made.

- Description: The merchant or service provider where the transaction occurred.

- Amount: The transaction amount charged to your card.

Carefully review each transaction for accuracy and flag any that seem unfamiliar or incorrect.

c. Interest Charges and Fees

This section details any interest accrued and fees charged, such as:

- Interest Charges: The cost of borrowing money on your credit card, applicable if you carry a balance beyond the due date.

- Late Payment Fees: Charged if you miss the payment due date.

- Over-Limit Fees: Incurred if you exceed your credit limit.

- Foreign Transaction Fees: Applicable on purchases made in foreign currencies.

Understanding these charges can help you avoid them in the future.

d. Rewards Summary (if applicable)

If your credit card offers rewards, this section will summarize:

- Rewards Earned: Points, cashback, or miles accumulated during the billing cycle.

- Total Rewards Available: The total rewards you have accrued to date.

e. Payment Information

This section provides details on how to make payments, including:

- Payment Options: Online payments, cheque, or auto-debit.

- Late Payment Implications: The consequences of not paying the minimum amount by the due date.

3. Tips to Understand Your Credit Card Statement

a. Focus on the Minimum Payment Due and Due Date

- Always pay at least the minimum amount by the due date to avoid penalties and protect your credit score.

- Aim to pay the full balance whenever possible to avoid interest charges.

b. Monitor Your APR (Annual Percentage Rate)

- Check the APR listed in your statement, as it determines the interest you’ll pay if you carry a balance.

- Different transactions (purchases, cash advances, balance transfers) may have different APRs.

c. Keep Track of Your Spending Categories

- Analyze where you’re spending the most and identify areas where you can cut back.

- Many statements categorize transactions, making it easier to understand your spending habits.

d. Look Out for Errors

- Review each transaction for accuracy.

- Report any discrepancies or unauthorized charges to your credit card issuer immediately.

e. Understand Grace Periods

- Most credit cards offer a grace period (typically 20-25 days) during which no interest is charged on new purchases if you pay your balance in full.

4. How to Avoid Common Pitfalls

a. Avoid Carrying a Balance

Carrying a balance beyond the due date leads to interest charges. Try to pay off your balance in full each month.

b. Beware of Cash Advances

Cash advances often come with higher interest rates and no grace period, making them an expensive option.

c. Keep Your Utilization Low

Use less than 30% of your credit limit to maintain a healthy credit score.

5. Leveraging Technology

Many credit card issuers offer online and mobile platforms to view and manage statements. These tools often include features like:

- Spending Insights: Visual summaries of your spending patterns.

- Alerts: Notifications for upcoming due dates or suspicious activity.

Conclusion

Understanding your credit card statement is crucial for effective financial management. By regularly reviewing and interpreting your statement, you can track your spending, avoid unnecessary fees, and protect your credit score. Take the time to go through each section carefully, and don’t hesitate to reach out to your credit card issuer if you have questions. Over time, this habit will empower you to make better financial decisions and achieve your money goals.

For more information on various other types of investments please click here

Open your Demat Account now and start Investing – Click Here